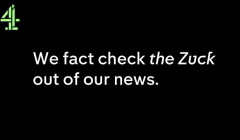

Channel 4’s fact checks the Zuck out of its news

The responsive campaign underlines the role of the news brand as a source of trusted news.

The Advertising Association/WARC Expenditure Report paints a positive picture for marketers, revising forecasts due to stronger-than-expected growth

Positive economic indicators from the UK marketing industry are proving to be more consistent than the British weather.

Following recent news that UK market budgets have hit a decade high, new data from the Advertising Association/WARC finds that ad spend increased 9.3% to £9.2bn during the first three months of 2024. The report features figures which set a new high for the first quarter period.

The Advertising Association/WARC Expenditure Report paints a positive picture for marketers, revising forecasts due to stronger-than-expected growth.

The recent General Election and Labour’s landslide victory is set to provide another boost for the industry in Q2, with figures expected to reach up to £9.7bn. Cultural moments like the Olympics are also set to provide opportunities for advertisers who are eager to spend and connect with audiences during key events. As a result, forecasts expect UK ad spend to rise 9.2% in Q2 (April to July) which would equate to a rise of 9.3% during the first half of 2024, to a total of £18.9bn.

After allowing for inflation, real growth for ad spend in Q1 stood at 5.5%. The UK advertising market saw a healthy £465m of organic growth.

“It is welcome news to see real-term growth and upgraded forecasts in the advertising market in Q1 this year, a positive sign that our industry is one of the driving factors in the UK’s economic recovery,” says Stephen Woodford, Chief Executive of Advertising Association.

Between January and March, search (including retail media) grew by 12.0% and online display (including social media) was up 12.8%. The report shows that the industry saw stronger-than-expected online growth in Q1 2024, with online formats accounting for 79.7% of all UK spend.

The data also showed a return to growth for cinema which rose 6.4%, as audiences continue to seek the connection and experience of cinematic events. TV saw an increase of 1.2% and BVOD also saw a continued strong increase at 19.2%. The rise in these channels signifies a renewed focus on long-term brand building as businesses move away from the urgency of short-termism as inflation eases.

“The race for AI adoption has intensified in the advertising industry, with major online platforms introducing their own solutions to market and subsequently reporting a positive contribution to their bottom line. The true impact of these tools will emerge in time, though first quarter results were certainly lifted by higher ad loads and associated performance costs online,” says James McDonald, Director of Data, Intelligence & Forecasting, WARC.

He continues: “That said, the enduring strength of legacy display media – chiefly TV, out of home, radio and cinema – was also evident in the first quarter, and we expect this to have sustained into the second due in part to short term stimuli such as the Men’s Euros and snap General Election. Overall, our outlook for the coming year is brighter than our last projection in April, with a forecast 7.7% rise in total ad spend this year ahead of the average rate recorded before the pandemic.”

|

Media |

Q1 2024 year-on-year % change |

2024 forecast year-on-year % change |

Percentage point (pp) change in 2024 forecast vs April |

2025 forecast year-on-year % change |

Percentage point (pp) change in 2025 forecast vs April |

|

Search |

12.0% | 10.1% | +1.2pp | 7.4% | +1.0pp |

|

Online display* |

12.8% | 8.8% | +2.4pp | 6.8% | +1.3pp |

|

TV |

1.2% | 3.9% | +1.3pp | 0.7% | -0.2pp |

|

of which BVOD |

19.2% | 13.7% | -0.4pp | 11.8% | +0.7pp |

|

Out of Home |

16.4% | 12.5% | +5.3pp | 6.8% | +1.2pp |

|

of which digital |

22.8% | 16.2% | +6.7pp | 7.5% | +5.9pp |

|

Online classified* |

1.1% | 1.2% | +1.8pp | 4.7% | +3.3pp |

|

Direct mail |

-2.5% | -3.3% | +1.6pp | -3.3% | No change |

|

National newsbrands |

-4.9% | -2.8% | +0.5pp | -3.3% | -1.3pp |

|

of which online |

-2.3% | 0.6% | +1.4pp | 1.0% | +0.2pp |

|

Radio |

7.0% | 5.5% | +3.2pp | 3.7% | +2.1pp |

|

of which online |

-5.9% | 4.0% | -3.5pp | 5.8% | +1.8pp |

|

Magazine brands |

-4.9% | -3.5% | +1.6pp | -2.2% | -1.5pp |

|

of which online |

-5.8% | -1.2% | +3.6pp | 2.8% | +0.8pp |

|

Reigonal newsbrands |

-4.4% | -3.3% | No change | -4.1% | -2.1pp |

|

of which online |

-1.1% | -0.3% | +1.4pp | -1.9% | -2.1pp |

|

Cinema |

6.4% | 4.4% | +1.9pp | 3.5% | +1.3pp |

|

TOTAL AD SPEND |

9.3% | 7.7% | +1.9pp | 5.5% | +1.0pp |

|

Note: Broadcaster VOD (BVOD), digital revenues for newsbrands, magazine brands, and radio broadcasters are also included within online display and classified totals, so care should be taken to avoid double counting. Online radio includes targeted in-stream radio/audio advertising sold by UK commercial radio companies, together with online S&P inventory. Source: AA/WARC Expenditure Report, July 2024 |

|||||

Looks like you need to create a Creativebrief account to perform this action.

Create account Sign inLooks like you need to create a Creativebrief account to perform this action.

Create account Sign in